Let’s Talk Credit Scores (and What They Mean for Your Home Loan)

Your credit score is a small number that can have a big impact when applying for a home loan. But don’t worry, we’re here to help you understand it.

What is a credit score?

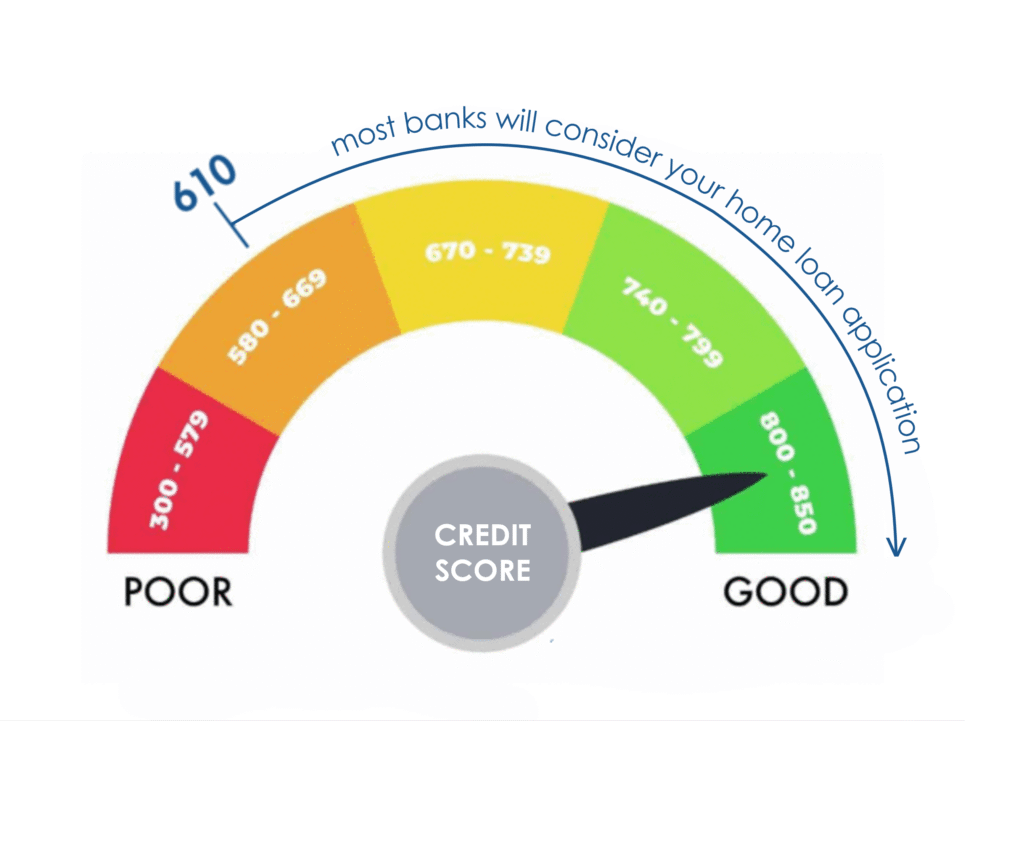

Your credit score is a snapshot of how you’ve managed debt in the past (credit cards, retail accounts, car loans, cell phone contracts). It shows lenders how reliable you are in paying back what you owe. In South Africa, scores range from 300 to 850:

- 300–579: Needs work

- 580–669: Getting there

- 670–739: Looking good

- 740–799: Great!

- 800+: Amazing

Based on credit scoring ranges from ClearScore South Africa

So, what score do you need to buy a home?

Banks also weigh your income, existing debt, and expenses when deciding — so even with a good score, affordability remains key. The good news is that you don’t need a flawless score to get a home loan. Most banks will grant a bond if your score averages 610 or above, although it also depends on how much money you make and how much debt you have. Also, the higher your credit score, the better your chances of getting a lower interest rate, which can add up to big savings in the long run.

Source: BetterBond’s guidelines on bond qualification

What if your credit score is not great?

You’re not alone — and this is where BetterBond steps in.

Instead of applying at just one bank, BetterBond sends your application to multiple banks to compare offers and find you the best possible deal — even if your score isn’t quite where you want it to be.

How to improve your credit score?

It takes time to build up a good credit score. In this case, having some debt can be a good thing as it provides a credit history. But it is very important to manage this debt well – pay your accounts fully and on time. Even minor arrears can have a big impact on your score.

Here are a few tips:

- Pay your bills on time

- Keep your credit card balance low

- Try pay off debt sooner than required

- Dispute inaccurate information on your credit report

- Limit applying for new credit too often

- Responsibly try to have a mix of credit types

Not sure what your score is?

You can check it for free (and safely) with ClearScore — no fees, no fuss.

Ready to buy?

Buying a home is a big step — but it doesn’t have to be overwhelming. At CentralBlue, we believe in making homeownership possible for more people, and that starts with being informed about things like credit scores. Get in touch with our experienced real estate team for more information.